august 2021 – october 2021

| Net sales | 1 818 (826) KSEK |

| Operating result before depreciation (EBITDA) | -2 733 (-2 946) KSEK |

| Net result | -3 901 (-4 777) KSEK |

| Earnings per share | -0.27 (-0.33) SEK |

| Gross margin | 93 (77) % |

MAY 2021 – OCTOBER 2021

| Net sales | 4 191 (957) KSEK |

| Operating result before depreciation (EBITDA) | -6 172 (-7 495) KSEK |

| Net result | -8 370 (-11 194) KSEK |

| Earnings per share | -0.58 (-0.78) SEK |

| Gross margin | 75 (64) % |

In short

- Strong sales growth for the 3rd consecutive quarter.

- The HoloMonitor fluorescence unit is planned to be launched in the first half of 2022.

- Recent advancements in regenerative medicine create additional growth potential in clinical applications for the company.

CEO Commentary

A window of opportunity created by the advancement of regenerative medicine

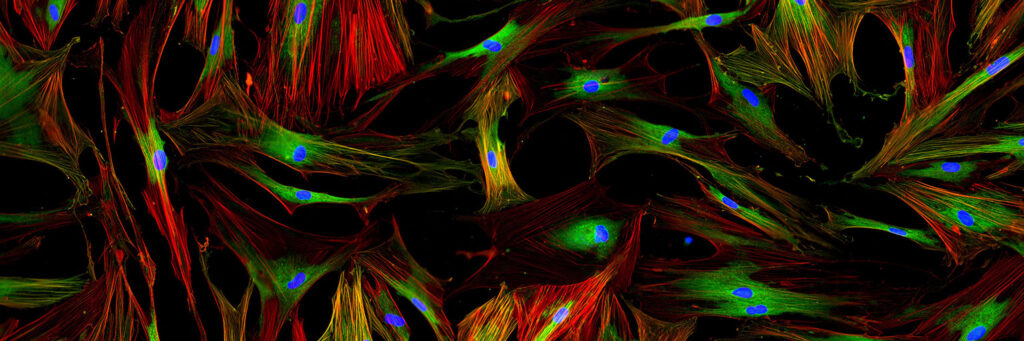

PHI spearheads the next generation of advanced instrumentation for non-invasive imaging and analysis of cell cultures. Today, cells are cultured in well over 100 000 laboratories worldwide, academic and commercial.

The growth rate and advances in regenerative medicine have motivated Big Pharma to enter the field. In regenerative medicine, the cells themselves are the treatment. Therefore, the number of cell culture laboratories and the market for non-invasive cell culture analysis is expected to grow rapidly over the coming years.

The growth is driven by the demand for large-scale cell culturing capacity to treat major diseases like diabetes, Parkinson’s, Alzheimer’s, heart disease and several cancer forms. As cell culturing transform from a craft to large-scale industry, the future number of clinical cell culture laboratories is expected to dwarf the current +100 000 pre-clinical laboratories.

In addition to its pre-clinical business, we see that PHI has a significant competitive advantage within regenerative medicine, given PHI’s proven core technology, proprietary software and cost position. Our customers have collectively published over 200 scientific papers based on results created by PHI’s non-invasive cell analysis technology. PHI’s more well-known customers include Bayer AG, National Institutes of Health, Harvard and Stanford University, and Novo Nordisk A/S.

The Future of Medicine

Regenerative medicine is the collective term for treatments that regrow, repair or replaces damaged or diseased cells, organs or tissues. The rapidly expanding field includes the generation and use of therapeutic stem cells, tissue engineering and the production of artificial organs.

The Future is Here

According to the latest report from Alliance for Regenerative Medicine, the number of ongoing regenerative medicine trials worldwide has grown to 2 600. 1 320 trials are industry-sponsored by nearly 1 200 companies. 243 of these trails are in Phase 3. As of October 2021, FDA has approved over 20 regenerative medicine treatments.

Also, according to the alliance, nearly 20 billion USD was invested in regenerative medicine during 2020, widely eclipsing the investments in 2019. With an annual growth rate of 10 – 30 %, market surveys estimate that the global regenerative medicine market has reached a value of up to 150 billion USD by 2028.

Source: Allied Market Research, MarketsandMarkets, Verified Market Research and GrandwiewResearch.

Third Pillar of Healthcare

Pharmaceuticals and surgery have been the two pillars of medical treatment for centuries. As now recognized by Big Pharma, regenerative medicine is set to become the third pillar of healthcare.

However, to fulfill its promise of curing a range of common diseases and to make treatment safe and accessible to all, regenerative medicine must transition from a craft (left) to a regulated large-scale industry where cells are grown in clean-rooms without manual handling (right).

Fluorescence Launch

For decades, medical scientists have used fluorescence microscopy to study the genetic activity of cells. However, the research community has become increasingly aware that the toxic side-effects created by fluorescence microscopy could lead to misleading results and incorrect conclusions. Academic and commercial scientists are therefore looking for non-invasive alternatives.

To date, there are no good solutions available to this toxicity problem. However, the integration of holographic and fluorescence microscopy in a single instrument solves this long-standing issue. By combining the two techniques, the number of fluorochromes and their use is minimized, reducing the amount of toxin released by the fluorochromes to a minimum.

Presently HoloMonitor addresses a market of well over 100 000 medical research laboratories. The vast majority of these laboratories use fluorescence today. HoloMonitor’s coming fluorescence capability will significantly strengthen the HoloMonitor product range. The add-on fluorescence unit will allow commercial and academic researchers to use fluorescence more efficiently while reducing the undesired toxic effects of fluorescence imaging.

The yet-to-be-named HoloMonitor fluorescence unit is planned to be launched in the first half of 2022, expanding PHI’s current product line.

HoloMonitor in Regenerative Medicine

The non-invasive qualities of HoloMonitor make it especially well-suited for regenerative medicine applications. As a result, the number of HoloMonitor units that have been purchased for use within regenerative medicine has increased notably over the past year. The most notable customers within the field are both Bayer AG and its subsidiary BlueRock Therapeutics. In July this year, BlueRock was granted an FDA Fast Track designation for their cell therapy for advanced Parkinson’s disease.

AI, Fluorescence and Holography

Modern AI software learns by example. Before training begins, a large training dataset is collected where each example is paired with the correct answer. For instance, a training dataset could be images of individual cells paired with the cell type.

The dataset is then presented to a network of digital “brain cells”. Each time the network gives the wrong answer, the network connections are adjusted to provide a more correct answer next time the example is shown to the network. Eventually, the network will learn to give the right answer for all the examples in the dataset.

Minimally invasive fluorescence is essential not only in pre-clinical research but also for identifying cellular transformations when developing biomanufacturing quality and process control standards.

During therapy production, the patient cells transform from the extracted to the desired cell type in several stages. As the cells will be transplanted back to the patient, it is by no means acceptable to stain or biochemically label the cells to assess the transformation progress.

By combining fluorescence imaging with holographic imaging, an AI-based system may be taught to recognize the intermediate cell types without fluorescence imaging. Each example in the training dataset is created by determining the cell type using fluorescence, while holographic imaging provides the example cell image. Provided there is sufficient discriminating information in the example images, the AI software will learn to recognize cell types without fluorescent labeling to remove the need for fluorescence imaging completely, as desired.

Biomanufacturing Consortium

As previously communicated, we entered a partnership with the Wake Forest Institute for Regenerative Medicine (WFIRM) and its biomanufacturing scale-up initiative RegenMed Development Organization (ReMDO) in August 2021. At both the federal and state levels in the United States, WFIRM is considered to be the leader of regenerative medicine.

To achieve the goal of industrializing regenerative medicine, WFIRM has identified several technologies that need to be developed, outlined in An Industry-Driven Roadmap for Manufacturing in Regenerative Medicine. WFIRM has further recognized that it cannot develop and promote these technologies on its own. WFIRM has therefore initiated the creation of a stakeholder consortium that brings industry, academia and government agencies together to facilitate regenerative medicine’s transition from craft to industry. PHI’s natural role in the established consortium would be to provide the critical non-invasive cell imaging and analysis technology outlined above.

Sales

As of last spring, sales have steadily increased. We anticipate that this positive sales trend will continue. However, we expect sales to be temporarily slower when international restrictions are imposed during pandemic surges. But, as we have seen, sales quickly rebound as soon as restrictions once again are lifted.

Rolling 12-month sales with trendline

Net sales and result

Net sales for the second quarter amounted to 1 818 (826) KSEK and operating results before depreciation (EBITDA) to -2 733 (-2 946) KSEK. The net result amounted to -3 901 (-4 777) KSEK.

Investments

With an emphasis on application development and the development of fluorescence capability, the company invested 1 246 (1 048) KSEK in the product, patent, and application development during the period.

Financing

Cash, cash equivalents, and unutilized granted credits amounted to 21 261 (21 595) KSEK by the end of the period. The equity ratio was -13 (62) %.

PHI has secured working capital until 2023. One of the loans from Formue Nord A/S of 20 000 KSEK, of the total approved loan amount of 35 000 KSEK, can be repaid in cash or by debt/equity swap, under certain specific conditions.

Based on that working capital is secured, calculation of the net sales value of inventories and valuation of intellectual property rights, the Board makes the assessment that the share capital is intact and that the company has sufficient working capital.

Risks

The company may be affected by various factors, described in the 2020/21 Annual Report. These factors may individually or jointly increase risks for the operation and result of the company.

Accounting principles

The accounts are prepared in accordance with the Annual Accounts Act and general advice from the Swedish Accounting Standards Board BFNAR 2012:1 Annual accounts and consolidated accounts (K3).

Review

This interim report has not been subject to review by the company’s auditor.

Statements about the future

Statements concerning the company’s business environment and the future in this report reflect the board of director’s current view of future events and financial developments. Forward-looking statements only express the judgments and assumptions made by the board of directors on the day of the report. These statements have been carefully assessed. However, it is brought to the reader’s attention that these statements are associated with uncertainty, like all statements about the future.

Calendar

- 23 of March 2022, Interim Report 3

About PHI

Phase Holographic Imaging (PHI) develops instrumentation and software for time-lapse cytometry. The products are used for long-term quantitative analysis of the dynamics of live cells, particularly significant in the research of cancer, as well as in the treatment of inflammatory and autoimmune diseases. The products are sold globally through the company’s distributors. The company is based in Lund, Sweden, and in Boston, Massachusetts.

On behalf of the Board of Directors

Peter Egelberg, CEO

For additional information please contact:

Peter Egelberg

Tel: +46 703 19 42 74

E-mail: [email protected]

Web: www.phiab.com

Consolidated – PHI Group

Income statement (KSEK)

| Q2 | Q2 | YTD | YTD | FY | |

| 2021/22 | 2020/21 | 2021/22 | 2020/21 | 2020/21 | |

| Net sales | 1 818 | 826 | 4 191 | 957 | 3 637 |

| Cost of products sold | -124 | -190 | -1 067 | -347 | -1 346 |

| Gross profit | 1 694 | 636 | 3 124 | 610 | 2 291 |

| Gross margin | 93% | 77% | 75% | 64% | 63% |

| Selling expenses | -1 891 | -1 874 | -3 961 | -3 482 | -8 773 |

| Administrative expenses | -1 658 | -1 025 | -3 715 | -3 859 | -7 084 |

| R&D expenses | -1 947 | -3 041 | -3 617 | -6 161 | -11 720 |

| Operating income | 523 | 1 723 | 1 972 | ||

| Operating result (EBIT) | -3 802 | -4 781 | -8 169 | -11 169 | -23 314 |

| Financial net | -99 | 4 | -201 | -25 | -195 |

| Result before tax (EBT) | -3 901 | -4 777 | -8 370 | -11 194 | -23 509 |

| Net Result (EAT) | -3 901 | -4 777 | -8 370 | -11 194 | -23 509 |

Balance sheet (KSEK)

| Q2 | Q2 | FY | |

| 2021/22 | 2020/21 | 2020/21 | |

| ASSETS | |||

| Non-current assets | |||

| Intangible assets | 15 674 | 14 954 | 14 823 |

| Tangible assets | 235 | 518 | 337 |

| Total non-current assets | 15 909 | 15 472 | 15 160 |

| Current Assets | |||

| Inventory | 2 499 | 1 604 | 1 334 |

| Short-term receivables | 3 211 | 2 981 | 2 938 |

| Cash and equivalents | 1 261 | 8 345 | 2 256 |

| Total current assets | 6 971 | 12 930 | 6 528 |

| Total assets | 22 880 | 28 402 | 21 688 |

| EQUITY AND LIABILITIES | |||

| Equity | -3 004 | 17 675 | 5 384 |

| Financial liabilities | 18 650 | 4 625 | 7 400 |

| Operating liabilities | 7 234 | 6 102 | 8 904 |

| Total equity and liabilities | 22 880 | 28 402 | 21 688 |

Changes in equity (KSEK)

| Q2 | Q2 | FY | |

| 2021/22 | 2020/21 | 2020/21 | |

| Opening Balance | 893 | 22 476 | 28 896 |

| Equity issues, net | |||

| Net profit | -3 901 | -4 777 | -23 509 |

| Translation difference | 4 | -24 | -3 |

| Closing balance | -3 004 | 17 675 | 5 384 |

| Equity ratio | -13% | 62% | 25% |

Cash flow analysis (KSEK)

| Q2 | Q2 | YTD | YTD | FY | |

| 2021/22 | 2020/21 | 2021/22 | 2020/21 | 2020/21 | |

| Operating activities | |||||

| Net result | -3 901 | -4 777 | -8 370 | -11 194 | -23 509 |

| Depreciation | 996 | 1 835 | 1 997 | 3 674 | 6 541 |

| Translation difference | 4 | -24 | -27 | -4 | |

| Operating cash flow | -2 901 | -2 966 | -6 373 | -7 547 | -16 972 |

| Increase (-)/decrease (+) in inventories | -890 | -211 | -1 165 | -74 | 196 |

| Increase (-)/decrease (+) in operating receivables | 347 | -824 | -273 | -470 | -348 |

| Increase (+)/decrease (-) in operating liabilities | -209 | -244 | -1 670 | 159 | 2 882 |

| Change in working capital | -752 | -1 279 | -3 108 | -385 | 2 730 |

| Cash flow from operating activities | -3 653 | -4 245 | -9 481 | -7 932 | -14 242 |

| Investing activities | |||||

| Development expenses | -1 246 | -1 048 | -2 747 | -1 707 | -4 091 |

| Patents | 1 | 1 | -170 | ||

| Tangible assets | |||||

| Cash flow after investments | -4 898 | -5 293 | -2 746 | -9 639 | -18 503 |

| Financing activities | |||||

| Net proceeds from equity issues | -18 | ||||

| Increase (+)/decrease (-) in borrowings | -8 | -250 | 11 250 | 3 500 | -6 275 |

| Cash flow from financing activities | -8 | -250 | 11 232 | 3 500 | 6 275 |

| Cash flow for the period | -4 906 | -5 543 | -995 | -6 139 | -12 228 |

| Cash and cash equivalents at the beginning of the period | 6 167 | 13 888 | 2 256 | 14 484 | 14 484 |

| Cash and cash equivalents at the end of the period | 1 261 | 8 345 | 1 261 | 8 345 | 2 256 |

| Incl. unutilized credits | 21 261 | 21 595 | 21 261 | 21 565 | 35 506 |

Data per share

| Q2 | Q2 | YTD | YTD | FY | |

| 2021/22 | 2020/21 | 2021/22 | 2020/21 | 2020/21 | |

| Earnings per Share, SEK | -0,27 | -0,33 | -0.58 | -0,78 | -1,63 |

| Equity per share, SEK | -0,21 | 1,23 | -0.21 | 1,23 | 0,37 |

| Number of Shares, end of period | 14 394 971 | 14 394 971 | 14 394 971 | 14 394 971 | 14 394 971 |

| Average number of shares | 14 394 971 | 14 394 971 | 14 394 971 | 14 394 971 | 14 394 971 |

| Share price end of period, SEK | 23.75 | 27.60 | 23.75 | 27.60 | 25.00 |

Parent company

Income statement (KSEK)

| Q2 | Q2 | YTD | YTD | FY | |

| 2021/22 | 2020/21 | 2021/22 | 2020/21 | 2020/21 | |

| Net sales | 656 | 1 015 | 2 478 | 1 137 | 2 991 |

| Cost of products sold | -142 | -424 | -1 067 | -581 | -1 358 |

| Gross profit | 514 | 591 | 1 411 | 556 | 1 633 |

| Gross margin | 78% | 58% | 57% | 49% | 55% |

| Selling expenses | -1 103 | -1 495 | -2 522 | -2 403 | -6 617 |

| Administrative expenses | -1 658 | -1 025 | -3 715 | -3 859 | -7 084 |

| R&D expenses | -1 947 | -3 041 | -3 617 | -6 161 | -11 720 |

| Other Income | 523 | 1 723 | 1 972 | ||

| Operating result (EBIT) | -4 194 | -4 447 | -8 443 | -10 144 | -21 816 |

| Financial net | -99 | 4 | -201 | -25 | -1 137 |

| Result before tax (EBT) | -4 293 | -4 443 | -8 644 | -10 169 | -22 953 |

| Net Result (EAT) | -4 293 | -4 443 | -8 644 | -10 169 | -22 953 |

Balance sheet (KSEK)

| Q2 | Q2 | FY | |

| 2021/22 | 2020/21 | 2020/21 | |

| ASSETS | |||

| Non-current assets | |||

| Intangible assets | 15 674 | 14 954 | 14 823 |

| Tangible assets | 235 | 518 | 337 |

| Financial assets | 942 | ||

| Total non-current assets | 15 909 | 16 414 | 15 160 |

| Current Assets | |||

| Inventory | 2 499 | 1 337 | 1 334 |

| Short-term receivables | 5 230 | 4 067 | 4 578 |

| Cash and equivalents | 7 998 | 1 711 | |

| Total current assets | 7 729 | 13 402 | 7 623 |

| Total assets | 23 638 | 29 816 | 22 783 |

| EQUITY AND LIABILITIES | |||

| Equity | -2 246 | 19 183 | 6 399 |

| Financial liabilities | 18 650 | 4 625 | 7 400 |

| Operating liabilities | 7 234 | 6 008 | 8 984 |

| Total equity and liabilities | 23 638 | 29 816 | 22 783 |