Interim Report 2 2019/20

August – October 2019

| Net Sales | 888 (539) KSEK |

| Operating result before depreciation (EBITDA) | -4 879 ( -4 593) KSEK |

| Net result | -6 761 (-6 035) KSEK |

| Earnings per share | -0.47 (-0.45) SEK |

May – October 2019

| Net Sales | 1 482 (1 395) KSEK |

| Operating result before depreciation (EBITDA) | -10 149 ( -7 727) KSEK |

| Net result | -13 917 (-10 553) KSEK |

| Earnings per share | -0.97 (-0.84) SEK |

In short

- Net sales for the quarter increased to 888 (539) KSEK.

- Gross margin amounted to 66 (68) %.

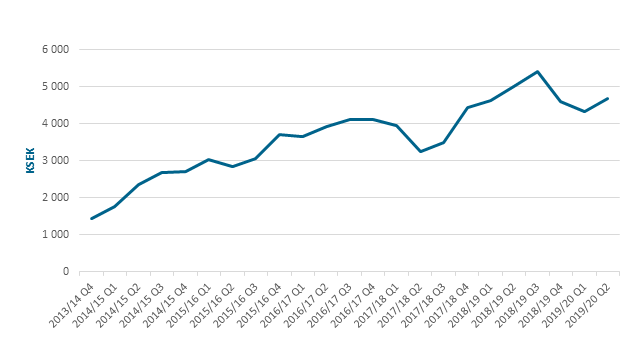

- Rolling 12-month sales amounted to 4.7 (5.0) MSEK.

- Significant order intake during the beginning of the 3rd quarter.

CEO Commentary

It is has become increasingly clear to science that the behavior of individual cells is far more significant for tumor growth and spreading than previously thought. A tumor is no longer considered to consist of a cluster of identical cancer cells. A tumor is rather a community of cancer cells in which some individuals are more dominant and sinister than others.

App Suite 3

Modern cancer research is focused on fighting these aggressive individuals, rather than the benign majority. As I mentioned in our previous report, HoloMonitor has a unique ability to identify, track and analyze individual cells — which was US National Institutes of Health’s rationale for selecting HoloMonitor over three other competing cell analyzers.

Clarity and simplicity are crucial to successful sales through strategic partnerships and larger sales organizations. When a product is perceived as difficult by the designated sales force, the risk is imminent that projected sales will fail to materialize.

The customer appreciated cell tracking functionally has for historical reasons been located in an older standalone software and has therefore been perceived as less accessible by the sales reps in particular. With the clear goal of achieving the critical simplicity, the software team has during the fall worked intensely to integrate the cell tracking with other functionality in the recently completed 3rd edition of the HoloMonitor software App Suite.

App Suite 3 with integrated cell tracking — Spatial Cell Tracking. Additional information regarding cell tracking with App Suite 3 is available at phiab.com/applications/single-cell-tracking.

Fluorescence

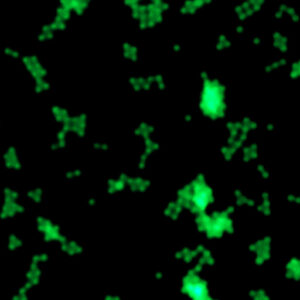

Despite an increasing number of instruments in operation, the number of service issues has steadily declined over the last year. This has freed up engineering resources and led to the decision to develop the by customers long sought-after fluorescence module for HoloMonitor.

In medical research, fluorescence labeling together with fluorescence microscopy is commonly used to identify and analyze cells biochemically. Contrary to when imaging with HoloMonitor's holographic microscopy technology, toxins are released every time cells are imaged with fluorescence microscopy, resulting in that the cells are gradually poisoned when imaged repeatedly. By combining the microscope techniques, the amount of released toxins and their harmful effect on the cells is minimized.

The fluorescence module greatly expands our addressable market. In the absence of alternatives, cell biologists have previously been forced to accept that the poisoning associated with fluorescence microscopy often lead to less reliable research results. By adding fluorescence capability to HoloMonitor, we largely eliminate the problematic poisoning and thereby create the basis for more medically relevant research results for our customers.

The growing selection of optical components for fluorescence imaging allows the fluorescence module to be designed completely without moving parts. This, in turn, means that the module will be manufactured for a favorable cost and sold as an accessory to both existing and new HoloMonitor customers, which would not have been possible just a few years ago with the then limited selection of components.

Fluorescent reference objects imaged with the HoloMonitor fluorescent module.

Sales

A late incoming order resulted in that sales growth for the quarter ended up lower than anticipated. On the other hand, the order together with other orders received after the period indicates that we can look forward to a stronger 3rd quarter.

Strategic partnerships

Finally, I would like to mention the discussions we are having with major industry players. Our establishment in the US together with the launch of App Suite 3 and the upcoming fluorescence module strengthens our position, but also our ability to attract additional stakeholders on a broader front. To take advantage of this new opportunity, we have for some time been working in parallel with the ongoing partnership discussions, with the aim of initiating discussions with the industry players that now also have come into play due to the recent developments.

Peter Egelberg, CEO

Net sales and result

Net sales for the second quarter amounted to 888 (539) KSEK and operating result before depreciation (EBITDA) to -4 879 (-4 593) KSEK. Net result amounted to -6 761 (-6 035) KSEK.

12-month rolling sales

Investments

With emphasis on application development, the company invested 617 (857) KSEK during the second quarter in patents, product, production and application development.

Financing

Cash, cash equivalents and unutilized granted credits amounted to 27 574 (35 836) KSEK by the end of the period. The equity ratio was 84 (84) %.

Directed equity issue

The AGM on October 15 decided to issue 15 817 shares in a directed equity issue for a subscription price of 28.20 SEK per share and a nominal value of 0.2 SEK per share. The issue, which was finalized after the period, increased the share capital by 3 163.40 SEK and was executed to fulfill obligations under guarantee agreements regarding subscription of warrants of series TO 2.

Risks

The company may be affected by various factors, described in the 2018/19 Annual Report. These factors may individually or jointly increase risks for the operation and result of the company.

Accounting principles

The accounts are prepared in accordance with the Annual Accounts Act and general advice from the Swedish Accounting Standards Board BFNAR 2012:1 Annual accounts and consolidated accounts (K3).

Review

This interim report has not been subject to review by the company’s auditor.

Statements about the future

Statements concerning the company’s business environment and the future in this report reflect the board of director’s current view of future events and financial developments. Forward-looking statements only express the judgments and assumptions made by the board of directors on the day of the report. These statements have been carefully assessed. However, it is brought to the reader’s attention that these statements are associated with uncertainty, like all statements about the future.

Calendar

Interim Report 3: March 12, 2020

On behalf of the Board of Directors

Peter Egelberg, CEO

For additional information please contact:

Peter Egelberg

Tel: +46 703 19 42 74

E-mail: [email protected]

Web: www.phiab.com